Special millage for education

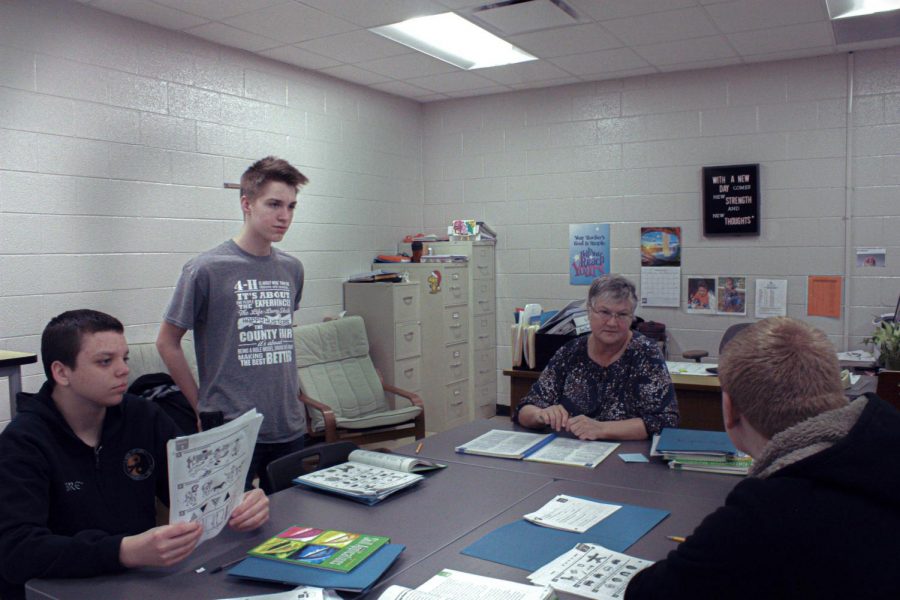

Students going over vocabulary questions with Mary Waterhouse.

A posting for a secondary special education teacher popped up February 4. This middle-of-the-semester opening signals need for assisting the growing population of special needs students and caseloads in the district. With steady growth, teachers just can not keep up.

A caseload is the number of students that a teacher must help to manage things like IEPs (individualized educational program), scheduling and making sure students are on track for post secondary goals and employment careers.

An average caseload for special education is 18 students. Anything over 20 is considered an overloaded class.

“There shouldn’t be any more than 23 students in a caseload,” SEA president and Chair of special education Mary Waterhouse said. “The junior senior high school is from 20 to 23 students right now.”

Considering the overloaded classes for special education, the district is reaching out for more funding as a part of a special millage.

On March 10, 2020 tax payers will be asked by the Ingham ISD to vote on a restoration millage for special education.

The Headlee Restoration millage increases the amount of money the district receives to fund the special needs for its students.

“Historically, special education throughout the state has been under funded,” special education teacher Kathleen Riley said. “That money from the millage would go toward hiring more teachers, hiring more paraprofessional support and being able to purchase new and updated curriculums to cater to the needs of all the students.”

Since 1988, the Special Education Millage in the Ingham ISD service area has eroded .2438 mill according to the Ingham ISD.

“The state-created Headlee Amendment caps property tax increases at the rate of inflation,” Executive Director of Public Relations and Communications for Ingham ISD Micki O’Neil said. “When the taxable values of properties rise faster than the rate of inflation, the actual tax levy is rolled back.”

Considering the Special Education millage has decreased, Ingham ISD has been collecting less revenue than originally approved by taxpayers.

If the restoration is approved, it would generate $2.3 million of special education funds annually. If not, it would not reduce the home property taxes for homeowners.

The extra details such as how much money each district will receive has not yet been determined. Local district and Ingham ISD representatives within the Special Education Finance Committee are still working on that aspect of the millage.

“The intent would be to provide more transitional types of support for kids that are moving on to skilled programs,” Waterhouse said. “The money is going to go to the ISD and then through there it would be dispersed to different schools and support additional programs.”